Der Department of Government Efficiency (DOGE) announced this week that it has canceled 30 leases for U.S. Food and Drug Administration (FDA) facilities across the country. This move, including the closure of a key drug testing facility in St. Louis, MO, is projected to save approximately $9 million in the next year and a total of $29.6 million over time.

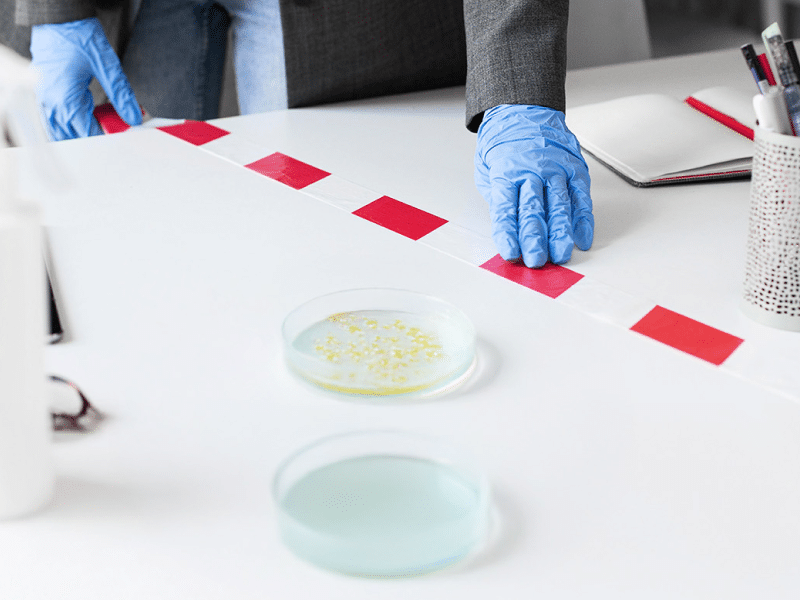

Industry experts and former FDA officials have raised concerns about the long-term effects of these closures. The St. Louis facility, which plays a crucial role in the FDA’s drug testing operations, is among the most significant closures.

- Howard Sklamberg, a former FDA deputy commissioner, warned that shutting down the St. Louis facility could increase risks to drug safety and efficacy in the long run.

- Drug manufacturers are responsible for their own quality control, but the FDA conducts independent inspections and testing—much of which was conducted at the St. Louis lab.

- The loss of this facility may weaken postmarket surveillance, reducing the FDA’s ability to detect unsafe or ineffective drugs.

Der General Services Administration (GSA), which manages federal properties, stated that the closures are part of a broader initiative to reduce government spending and optimize federal office space.

- Acting GSA Administrator Stephen Ehikian emphasized that eliminating underutilized assets will reduce maintenance liabilities and improve space utilization.

- Der White House and the Department of Health and Human Services (HHS) have not clarified whether FDA employees at the affected facilities will lose their jobs or be reassigned.

GSA’s Public Buildings Service (PBS) has identified 440 non-core assets, including FDA properties, that may be sold or repurposed to save an estimated $430 million annually.

Der Trump Administration’s cost-cutting measures have sparked debate over whether these reductions are being implemented responsibly:

- Stephen Grossman, an FDA regulatory consultant, criticized the approach, stating that “layoffs and facility closures should follow a structured evaluation process, not be done by fiat.”

- DOGE initially claimed $16 billion in savings, but independent reviews have revised this figure down to $9 billion.